Key Takeaways

- Nvidia CEO Jensen Huang remains optimistic about strong demand for GPUs despite market fluctuations and competition from AI startups like DeepSeek.

- The company’s data center sales surged 93% to $35.6 billion, contributing to a 78% revenue increase in Q4.

- Blackwell, Nvidia’s latest GPU package for large-scale AI, is in high demand as data centers shift focus towards accelerated computing.

Strong Demand for Nvidia’s GPUs amidst AI Competition

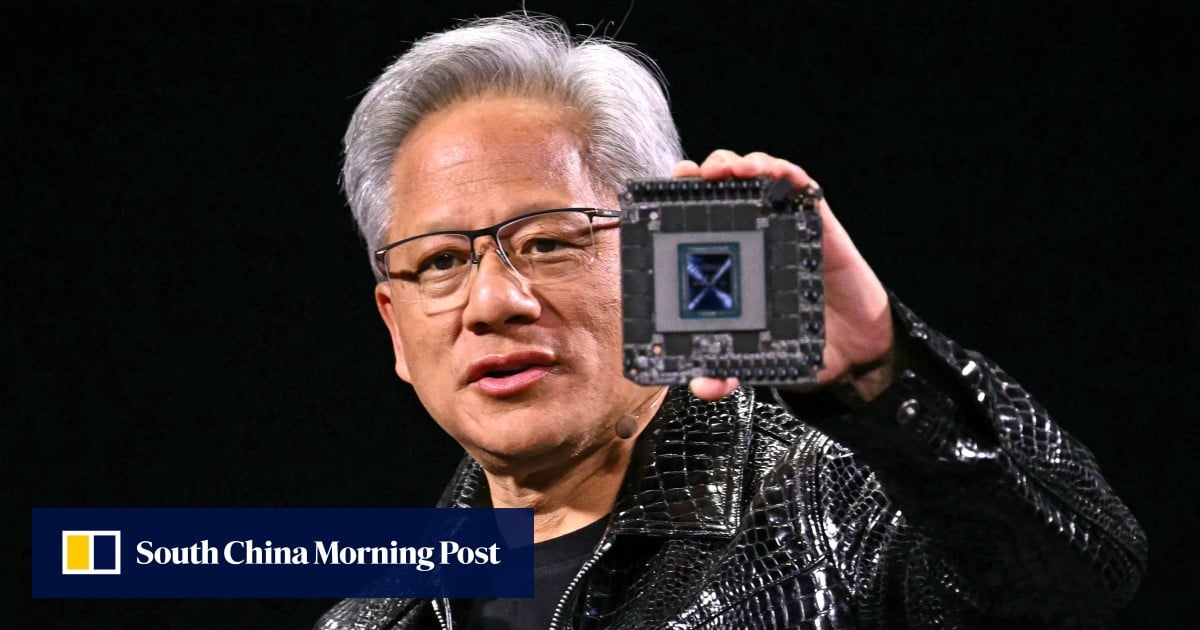

Nvidia’s CEO Jensen Huang expressed unwavering confidence in the ongoing demand for the company’s graphics processing units (GPUs), despite recent uncertainties triggered by the rise of AI startup DeepSeek. DeepSeek gained attention for its ability to create large language models more efficiently than many Western companies, leading to initial concerns that this could dampen Nvidia’s GPU sales. This speculation coincided with Nvidia’s significant market value drop of nearly $600 billion last month, marking the steepest single-day decline for any US company, before starting to recover the following day.

Recent data from Nvidia indicates that demand has remained robust, particularly in the data center segment, which saw an impressive growth of 93%, reaching $35.6 billion. During a conference call, Huang described the demand for Nvidia’s latest products, specifically their Blackwell GPU package, as “extraordinary.” This surge in demand comes alongside a 3.7% rise in Nvidia’s stock price, suggesting market confidence in its future performance.

Huang noted that the emergence of new reasoning models has resulted in a revised scaling law—indicating that larger training datasets and model parameters contribute to increased model intelligence. He mentioned models such as OpenAI’s, Grok3, and DeepSeek-R1 that are applying these principles during inference time scaling. According to Huang, as data centers continue to invest heavily in accelerated computing and AI capabilities, Nvidia remains well-positioned to capitalize on this trend.

Research from Morningstar strategist Brian Colello supports Huang’s optimism, stating there are “no meaningful signs that data center demand is waning in the near-term,” despite the late January sell-off in Nvidia shares. The company reported substantial financial growth, achieving a 78% year-on-year revenue increase that amounted to $39.3 billion for the fourth quarter ending January 26. For the entire fiscal year, revenues skyrocketed by 114% to reach $130.5 billion, further establishing Nvidia’s position as a pivotal player in the AI boom.

China constitutes a notable part of Nvidia’s market, accounting for approximately 13% of revenue in the 2025 financial year. However, US restrictions remain a challenge, limiting the sale of Nvidia’s most advanced products in the Chinese market. Despite these hurdles, the primary focus remains on the increasing demand for GPUs, particularly for large-scale AI applications as data centers commit significant resources to advanced computing technologies.

The content above is a summary. For more details, see the source article.