Key Takeaways

- The Pentagon’s Office of Strategic Capital (OSC) will focus its 2025 investments on 15 critical industry segments supporting U.S. national security.

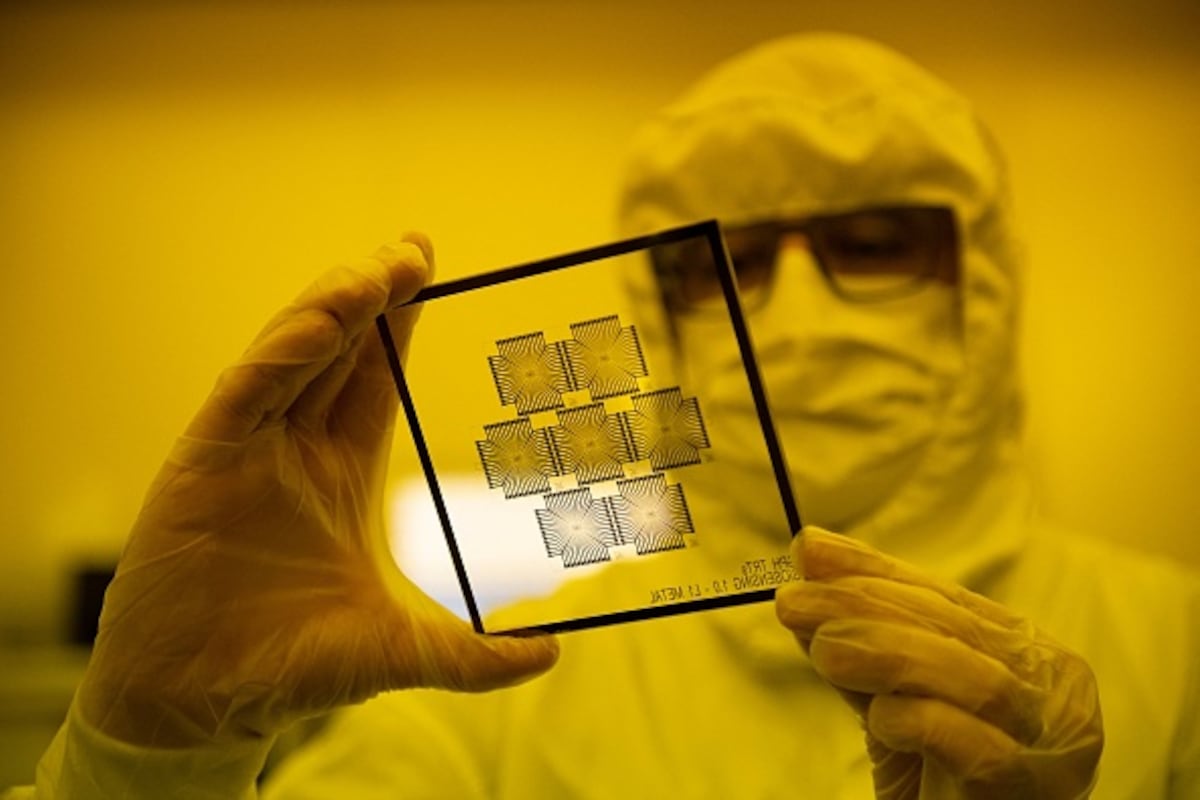

- Significant areas of investment include spacecraft, microelectronics, biochemicals, and autonomous technologies.

- OSC aims to enhance U.S. competitiveness by providing loans and incentives to private sector companies in defense technologies.

Investment Strategy for National Security

The Pentagon’s Office of Strategic Capital (OSC) has announced its investment strategy for fiscal year 2025, emphasizing support for 15 key industry segments deemed vital for U.S. national security. These focus areas include spacecraft, microelectronics materials and manufacturing, biochemicals, biomanufacturing, hydrogen generation and storage, autonomous vehicles, and sensor hardware.

Established by Defense Secretary Lloyd Austin in 2022, the OSC plays a pivotal role in directing private sector investment towards defense technologies. Following the organization’s authorization by Congress to offer loans and loan guarantees, OSC has actively engaged with the private sector to bolster U.S. capabilities.

In 2023, OSC committed to providing $1 billion in direct loans to companies producing essential defense components. This initiative targets scaling production across 31 critical defense technologies, aiming to reduce reliance on foreign supply chains and mitigate potential vulnerabilities.

In late October 2023, OSC approved 13 private funds for its inaugural Small Business Investment Company Critical Technology Initiative (SBICCT), aimed at attracting private investment in defense-relevant technology sectors. OSC Director Jason Rathje highlighted the importance of this program, stating it incentivizes capital markets to engage more actively in critical technology investments by changing the expected returns for investors.

For fiscal 2025, OSC intends to develop new financial products tailored to the identified industry segments, promoting a stronger defense industrial base. Its comprehensive strategy includes a framework for prioritizing near-, mid-, and long-term investments, which will focus on minimizing supply chain dependencies and creating diverse technology sources.

In the immediate term, OSC’s financial products are designed to address industry-specific chokepoints and foster growth within crucial sectors. For the next two to seven years, the organization envisions scaling production capabilities for U.S. and allied nations, directly supporting the military’s technological needs.

Long-term strategies, extending up to 15 years, include commercializing technologies to develop sustainable enterprises. OSC’s funding initiatives signify a commitment to accelerating the growth of emerging industries crucial to national defense. The framework will facilitate lower capital costs to foster investment in technology sectors requiring long-term financial involvement, a vital step in the evolving landscape of defense readiness.

Courtney Albon of C4ISRNET, who has reported on military developments since 2012 with a focus on the Air Force and Space Force, elaborates on the significance of OSC’s approach to modernizing the defense sector. The OSC’s proactive investment strategy represents a shift towards enhancing the U.S. competitive edge in critical technologies essential for national security.

The content above is a summary. For more details, see the source article.