Key Takeaways

- Global lithium-ion battery pack prices dropped 20% in 2024, marking the largest decline since 2017, driven by increased competition and production.

- China dominates the battery market, producing 80% of global battery cells while leading in lithium iron phosphate (LFP) technology.

- The U.S. is gradually increasing battery manufacturing capacity, but potential tax credit eliminations could hinder growth in this sector.

Battery Price Decline Fuels EV Market

A report from the International Energy Agency (IEA) reveals that the prices for lithium-ion battery packs experienced a significant drop of 20% in 2024, the most substantial reduction since 2017. This price decline plays a crucial role in making electric vehicles (EVs) more affordable, as battery costs represent the largest expense for manufacturers. As a result, demand for EVs continues to be a primary driver for battery production.

The decrease in battery prices is attributed to intensified competition, increased production capabilities, and heightened demand for electric vehicles. Specifically, lithium prices have also fallen nearly 20%, reverting to levels observed in late 2015, even though demand has surged to six times that of 2015.

China has emerged as a formidable player in the battery market, responsible for 80% of global battery cell production in 2024. This advantage is attributed to its established supply chain and advanced technological development. The competitive environment in China has led to reduced profit margins for producers while enhancing manufacturing efficiency and workforce capabilities.

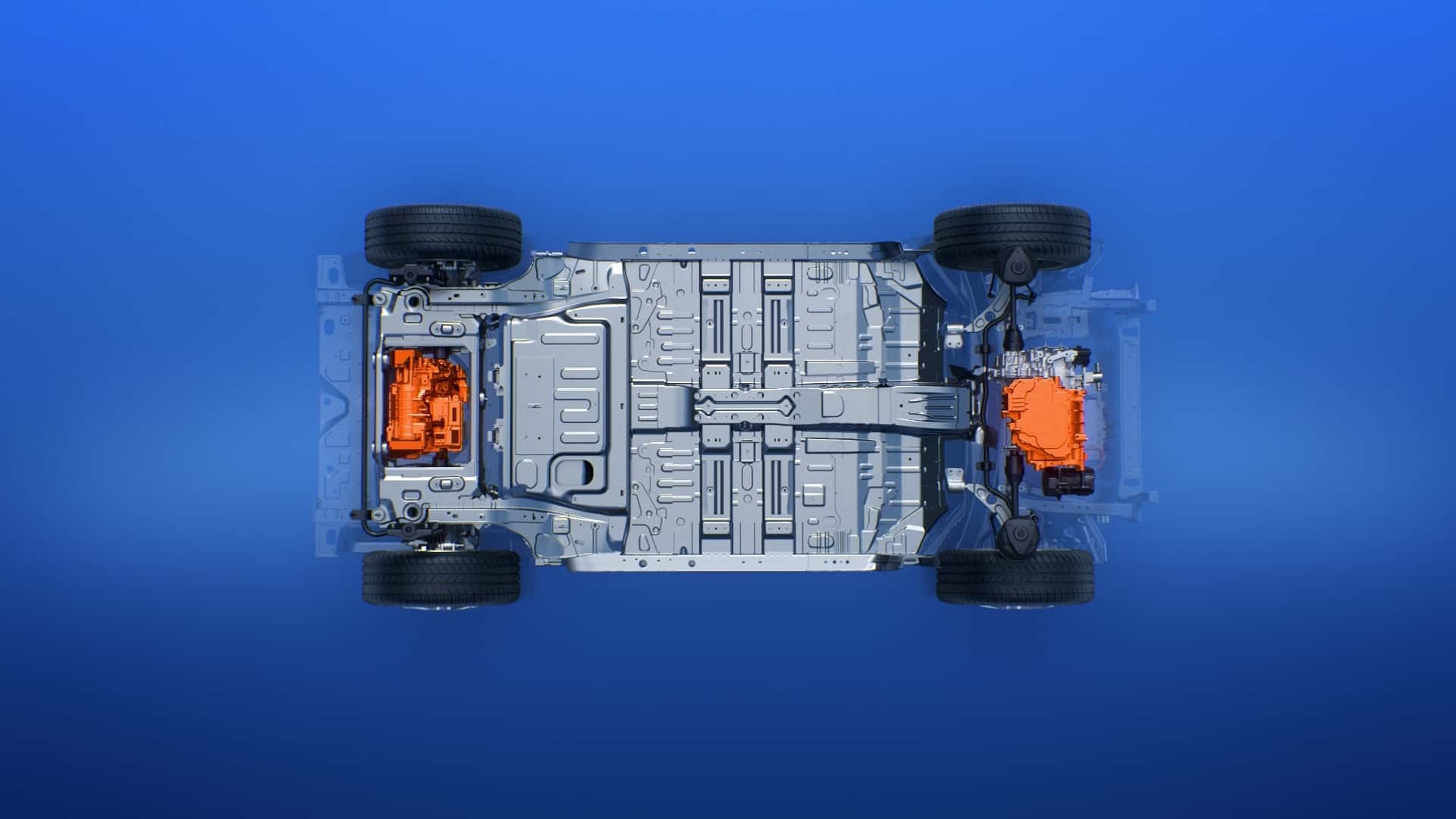

Interestingly, hybrid batteries are costing more than electric vehicle (EV) batteries, despite their smaller size. This cost disparity stems from a lower number of battery cells in hybrids, which inflates the price per kilowatt-hour. The average cost of a 20 kWh battery pack for plug-in hybrids aligns closely with that of a larger 65 kWh battery pack for pure electric vehicles.

LFP batteries, which are predominantly produced in China, make up a significant portion of the global EV battery market, accounting for nearly half. Their adoption has surged, particularly in the European Union where usage increased by about 90% in 2024. However, in the United States, LFP adoption remains limited at 10% due to ongoing tariffs against China. In other regions, such as Southeast Asia, Brazil, and India, LFP batteries have swiftly captured over 50% of the market share, facilitated by imports from China and domestic production in India.

On the manufacturing front, the U.S. is showing signs of progress, with production capacity rising nearly 50% in 2024. This increase is largely driven by Korean companies taking advantage of tax credits, helping the U.S. surpass the European Union in battery manufacturing capacity, despite the EU’s 10% growth. However, the future of these tax incentives is uncertain, particularly with proposed legislation that could eliminate them.

While the global battery market is expanding, its future trajectory in the U.S. will depend on policies regarding tax credits and incentives for domestic battery manufacturing. The ability of the U.S. to maintain a competitive edge in this rapidly evolving industry is at a crucial juncture.

The content above is a summary. For more details, see the source article.