Key Takeaways

- The U.S. is ending the de minimis exemption, affecting duty-free imports valued at $800 or less.

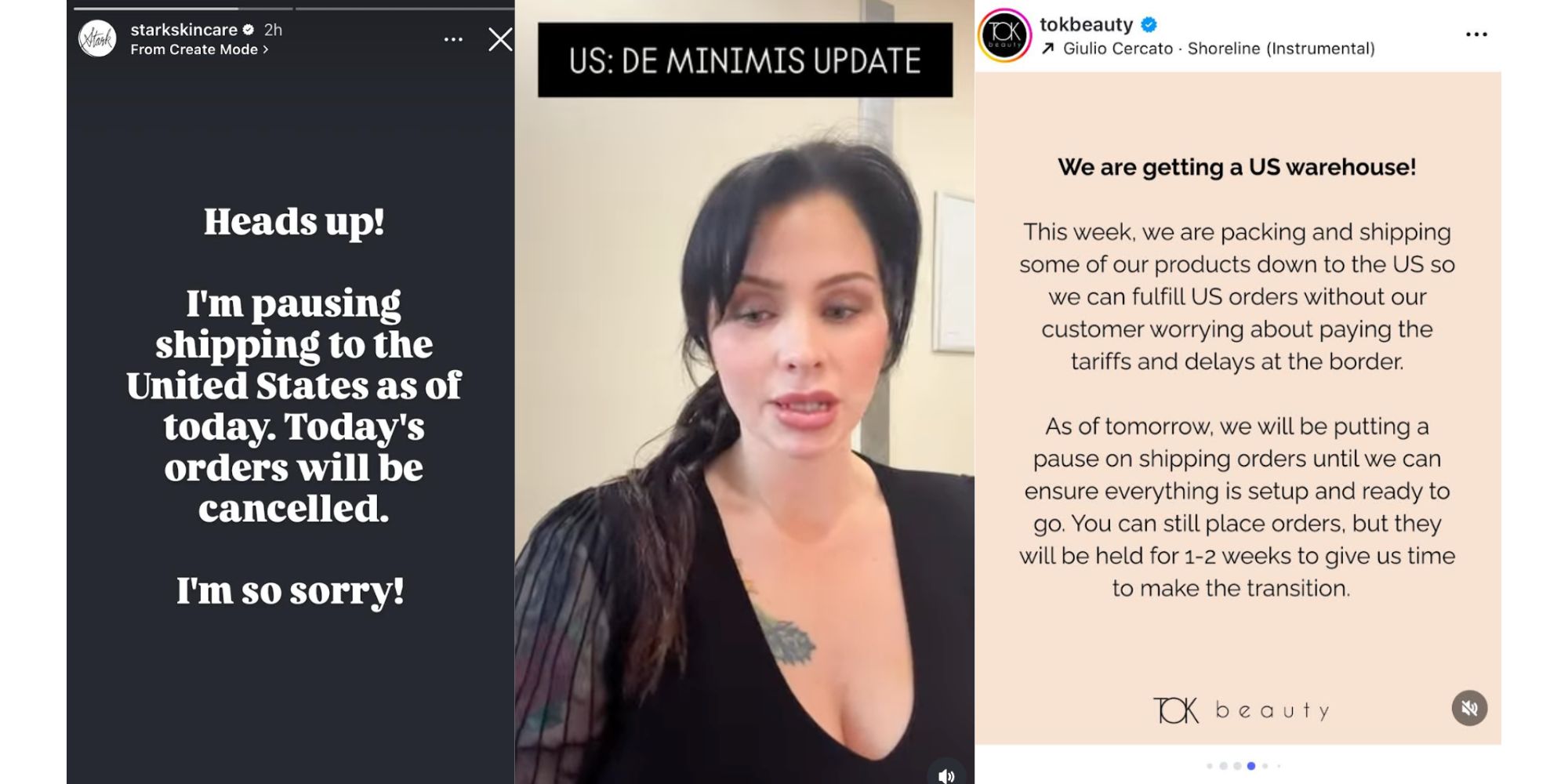

- Indie beauty brands are halting U.S. shipping, risking significant revenue losses and exploring U.S. warehousing options.

- Many brands still plan to maintain relationships with U.S. customers despite the challenges posed by new tariffs.

Impact of Changes to E-Commerce Shipping

The U.S. is set to eliminate the de minimis exemption, which previously allowed for the import of goods valued at $800 or less without tariffs or extensive customs checks. This change, which follows a similar ban on shipments from Hong Kong and China earlier, is expected to create significant challenges for international e-commerce, particularly impacting indie beauty brands seeking to serve American customers.

Last fiscal year, nearly 1.4 billion shipments took advantage of this exemption, easing burdens on the U.S. Customs and Border Protection. However, with the loophole closing, businesses could face duties ranging from $80 to $200 per parcel, depending on the originating country’s tariff rates. In response to the impending changes, indie beauty brands in Canada, Australia, and elsewhere have begun notifying customers and ceasing shipments to the U.S.

Retail giants are also feeling the effects. For instance, South Korea’s Olive Young announced a 15% customs duty on all U.S. orders, while the British beauty retailer Space NK stopped online sales to American consumers. Brands are now pivoting to strategies like expanding into new markets to offset the expected decline in U.S. sales.

One such brand, Stark Skincare from Montreal, has suspended U.S. shipping and canceled same-day orders, affecting about half its customer base. Founder Jessica Lafleur has expressed profound concern, especially with the critical holiday season approaching. She mentioned that attempts to establish alternative shipping methods or post offices have been challenging, as the postal system remains unclear regarding new directives.

Stark’s situation is echoed by Toronto-based Glow Green Co., which is considering U.S. warehousing options for future shipping without customs delays. Their customer base has shifted significantly toward the U.S., where they’ve seen a 40% repeat purchase rate since targeting American consumers. The founder, Jean Raffiuddin, expressed disappointment over the temporary pause in U.S. deliveries, citing lost momentum and the challenges of starting over once resuming.

Ever Amid, another Canadian brand, is making efforts to diversify its customer base, which is currently 90% American due to a partnership with an e-tailer. However, the brand’s founder, Nadine Boyd, is optimistic that once the logistics stabilize, customer loyalty will endure despite the shipping pause.

As businesses navigate this complex change, experts advise readiness for further fluctuations. Laura Burget of Three Ships emphasizes the importance of contingency planning and horse-trading, given uncertainties surrounding future tariff rates.

Overall, while some brands contemplate expanding into new markets, the common sentiment is one of reluctance to abandon U.S. consumers entirely. Many businesses recognize the value of the relationships built over years, which extend beyond sales figures. The shipping halt is therefore viewed as a temporary setback in a long-term strategy to maintain presence and connections with American customers.

The content above is a summary. For more details, see the source article.