Key Takeaways

- Cleveland-Cliffs has secured a multi-year steel supply agreement with U.S. automakers, moving away from annual contracts.

- The deal aims to provide cost stability amidst new tariffs on imported steel, benefiting both the automaker and Cleveland-Cliffs.

- Wall Street analysts suggest a Hold rating for CLF stock, projecting modest upside potential.

Multi-Year Steel Supply Agreement

Cleveland-Cliffs (CLF), a prominent steelmaker, saw its stock decline despite announcing a multi-year agreement to supply steel to select U.S. automakers at fixed prices. This three-year contract marks a significant shift from the company’s traditional one-year agreements, reflecting changes in U.S. trade policies that have imposed tariffs as high as 50% on imported foreign steel.

By securing this agreement, Cleveland-Cliffs aims to provide U.S. automakers with predictable pricing for sheet steel, thereby shielding them from the impacts of tariff-induced price volatility. Although specific automakers involved in this deal have not been publicly disclosed, sources from Bloomberg suggest potential buyers may include General Motors (GM), Ford (F), and Stellantis (STLA), all of which currently obtain steel from Cleveland-Cliffs.

CEO Lourenco Goncalves highlighted last month that the company’s U.S.-based operations position it favorably amidst changing trade dynamics. This arrangement enhances Cleveland-Cliffs’ presence in the automotive sector while offering automakers a buffer against fluctuating costs.

Following recent changes in trade regulations, Cleveland-Cliffs has experienced a nearly 80% increase in its share price since May, signaling a positive shift in investor sentiment.

Stock Performance and Analyst Insights

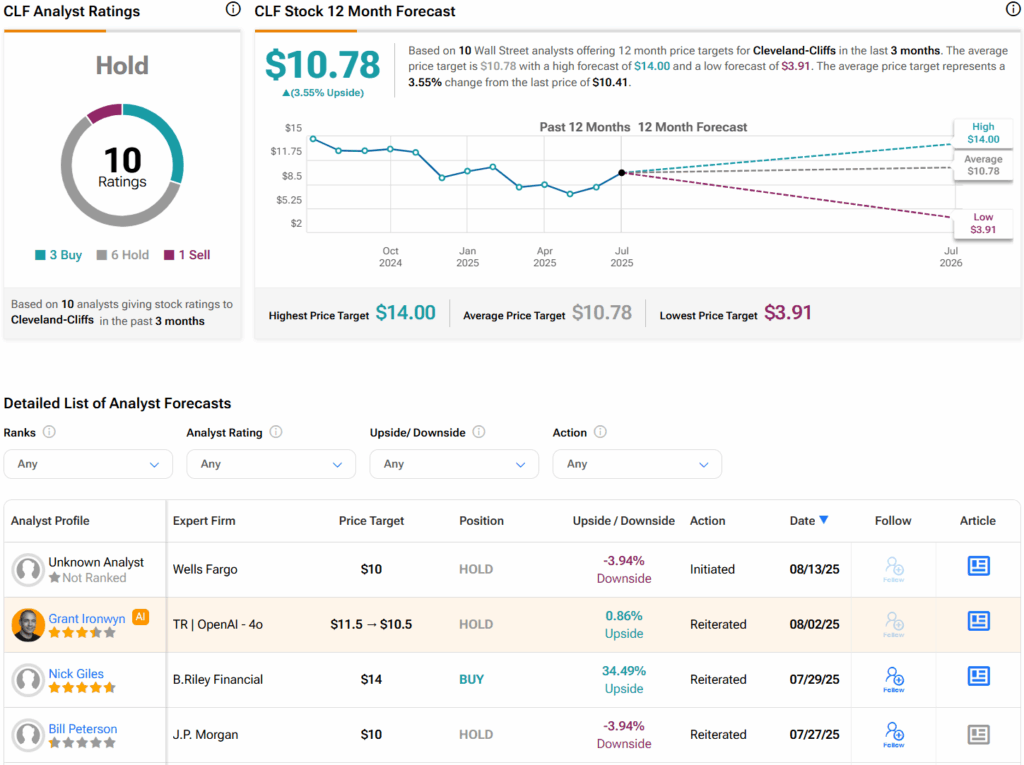

Regarding stock performance, Wall Street analysts are currently maintaining a Hold consensus rating for Cleveland-Cliffs. This assessment is based on three Buy ratings, six Holds, and one Sell recommendation recorded over the past three months. The average price target for CLF shares stands at $10.78, suggesting a potential upside of 3.6%.

The situation reflects the significance of long-term contracts and the evolving trade landscape, which are influential factors in investor decision-making. As Cleveland-Cliffs continues to adapt to these market conditions, its strategic moves could further solidify its position within the steel and automotive industries.

The content above is a summary. For more details, see the source article.