Key Takeaways

- House Republicans’ new tax bill risks increasing electricity costs for Americans while phasing out crucial solar credits.

- The removal of these tax credits could lead to a 7% rise in electricity bills for consumers and a 10% increase for businesses by 2026.

- Concerns arise over potential job losses and decreased competitiveness in the EV and AI sectors due to reduced solar energy incentives.

Tax Bill Threatens Energy Costs and Innovation

House Republicans recently passed a tax bill that is expected to raise electricity costs for Americans and diminish the incentives for solar energy production. This legislation is poised to transfer financial burdens from the middle class to billionaires while potentially harming the job market and increasing costs across various sectors.

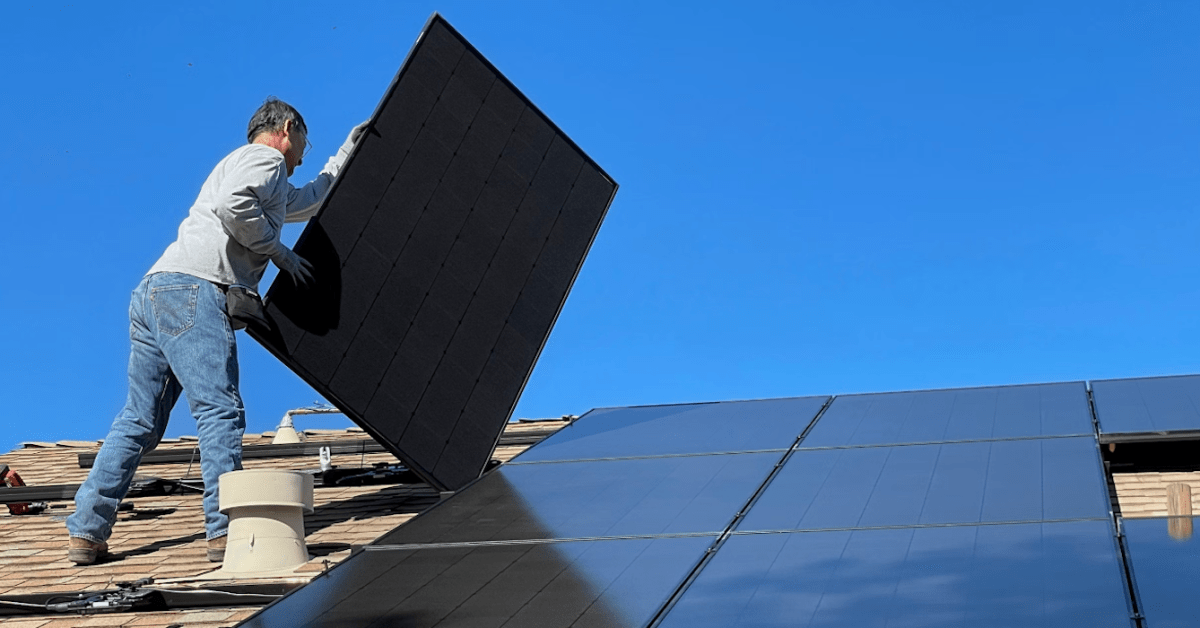

The proposed tax bill seeks to eliminate the 30% residential solar tax credit, known as the Investment Tax Credit (ITC), which has been instrumental in helping homeowners reduce their electricity expenses. If this bill is enacted, the residential credit will phase out by the year’s end, while commercial credits will also decrease at an accelerated rate compared to current regulations.

According to a report from the Clean Energy Buyers Association, repealing the ITC could lead to an average 7% increase in residential electricity bills by 2026, equating to an additional $110 per year for consumers. For businesses, energy costs may go up by about 10%, resulting in higher prices for everyday goods as these costs are passed on to consumers.

This tax credit has significantly boosted the adoption of solar energy in the U.S., with 98% of new electrical generation capacity in earlier months of the year coming from wind and solar. Increasing electrical generation capacity is crucial as the country witnesses a rapid scaling of electricity-dependent industries like electric vehicles (EVs) and artificial intelligence (AI).

Despite the energy efficiency of electric vehicles, which are 4-6 times more efficient than gasoline cars, the transition from gas to electric requires substantial infrastructure improvements. As the demand for electricity rises, especially with the expansion of data centers—which are essential for AI technologies—efforts to boost solar energy production face potential setbacks.

Selling solar energy installations has become an attractive option for data centers aiming to find greener energy sources and mitigate their significant energy consumption. Solar energy, in particular, is favored for its quick deployment and ability to utilize available space, such as rooftops.

By curtailing solar initiatives, the bill could hinder U.S. competitiveness in the global market. Countries like China are advancing rapidly in both AI and EV technology, establishing themselves as leaders in these sectors, while U.S. entities may struggle to catch up due to increased operational costs and reduced energy options.

As this legislation moves to the Senate, there are opportunities for revisions that could eliminate these adverse effects on electricity affordability and international standing. Constituents are encouraged to reach out to their Senators, advocating for the preservation of solar incentives which are vital for both economic and environmental sustainability.

Should the residential solar credit be repealed, homeowners have a limited window to install solar systems before experiencing average price hikes of around $10,000. Urgent action is recommended for those considering solar adoption to maximize financial benefits before changes take effect.

The dialogue continues about the importance of maintaining competitive energy strategies while safeguarding consumer interests. Both parties must ensure that the future of U.S. energy remains robust, efficient, and aligned with global energy advancements.

The content above is a summary. For more details, see the source article.