Key Takeaways

- The U.S. will allow NVIDIA and AMD to sell specific AI chips to Chinese firms, potentially increasing China’s foreign AI chip procurement share to 49%.

- Strong demand from U.S. customers will lead TSMC to accelerate its production schedule at Arizona fabs, while EDA and silicon IP revenue saw significant growth.

- China faces hurdles in advanced semiconductor technology, despite progress in other areas, as evidenced by multiple phishing campaigns aimed at its semiconductor industry.

New Opportunities for AI Chips in China

The U.S. government plans to grant licenses for NVIDIA and AMD to sell specific AI chips, including NVIDIA’s H20 GPU and AMD’s MI308, to Chinese companies. This decision is expected to create heightened demand from Chinese AI firms and cloud service providers, potentially boosting China’s share of foreign AI chip procurement to 49%. Despite ongoing geopolitical tensions and local competition, these chips may reestablish NVIDIA’s H20 as the preferred high-end AI accelerator in China.

The Center for Security and Emerging Technology (CSET) has analyzed China’s advancements in semiconductor manufacturing, noting improvements in various manufacturing tools such as CMP, dry etch, and deposition tools. However, significant challenges remain for more intricate technologies, particularly in lithography.

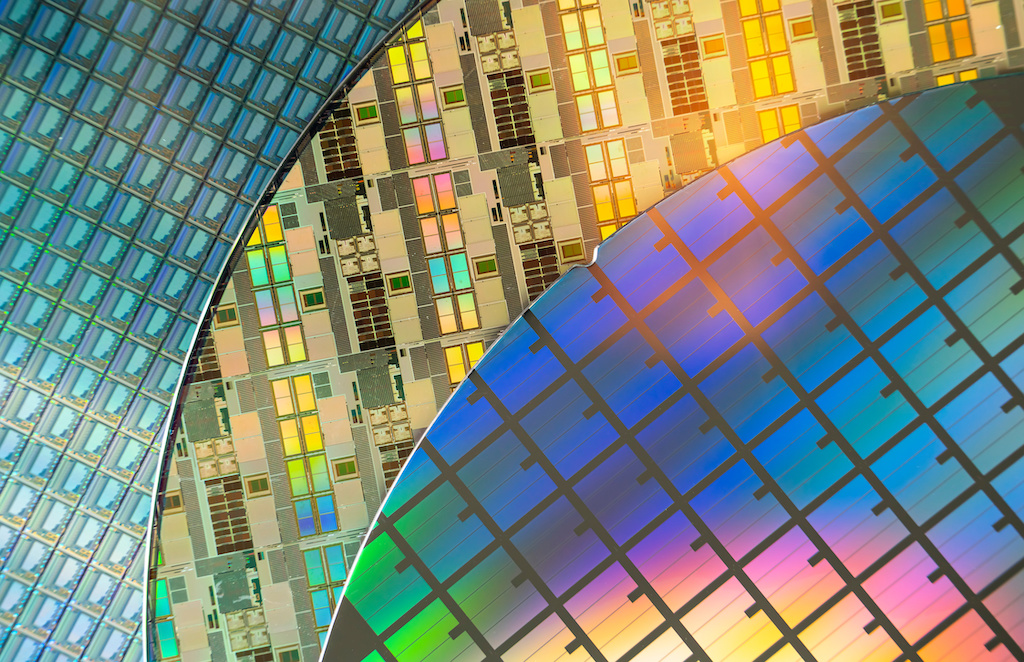

TSMC Production & Acquisitions Expand Capacity

In related news, TSMC has decided to speed up its production timelines at its Arizona plants to meet the soaring demand from U.S. customers. Meanwhile, Synopsys recently finalized its $35 billion acquisition of Ansys, enhancing its capabilities for complex System on Chips (SoCs) and multichip designs. Synopsys anticipates introducing integrated capabilities in early 2026, covering the full Electronic Design Automation (EDA) stack.

New Technologies and Threats

Nikon is set to accept orders for its new DSP-100 Digital Lithography System, designed for advanced packaging and semiconductor manufacturing. This system promises high throughput with 1.0μm resolution while accommodating 600mm² substrates.

In security, Proofpoint identified three state-sponsored phishing campaigns targeting the Taiwanese semiconductor industry, likely aimed at espionage. These campaigns underscore the persistent cybersecurity threats facing the semiconductor sector.

In the first quarter of 2025, revenue from EDA and silicon intellectual property (IP) reported nearly a 13% increase, reaching around $5.1 billion. The IP segment alone grew by 29% year-over-year, reflecting strong market health and investor interest. In Q2 2025, innovation in the industry attracted $1.9 billion in funding across 75 startups, focusing on diverse technologies from superconducting logic to novel power semiconductor architectures.

Regional Developments in the Semiconductor Industry

In the United States, notable developments include the opening of the CHIPS for America EUV Accelerator facility in New York and a significant $20 million investment in a SiC facility at Stony Brook University. Conversely, Broadcom has canceled its microchip plant project in Spain due to unsuccessful negotiations with the Spanish government.

In Asia, the Center for Strategic and International Studies (CSIS) has highlighted an expanding threat from China’s gallium export restrictions, urging the U.S. to seek alternative sources. Japan’s JS Foundry has filed for bankruptcy, marking a setback in its efforts to advance semiconductor production capabilities.

Overall, the semiconductor industry is in a state of growth and transformation, with new technologies, investments, and geopolitical dynamics shaping its future landscape.

The content above is a summary. For more details, see the source article.