Key Takeaways

- US semiconductor trade data underreports imports embedded in finished products, affecting tariff policies.

- Most imported chips are actually produced in the US, leading to potential penalties for domestic manufacturers if tariffs are imposed.

- Tariffs should focus on Chinese-made chips, while fostering zero-tariff agreements with allies to enhance supply chain resilience.

Understanding Semiconductor Trade Dynamics

The U.S. semiconductor trade has complex dynamics. Much of the $40 billion in semiconductor imports includes chips made in the U.S. but packaged abroad, which can lead to unintended consequences if tariffs are applied indiscriminately. The U.S. has limited packaging capacity, meaning that higher tariffs could harm domestic manufacturers and increase production costs.

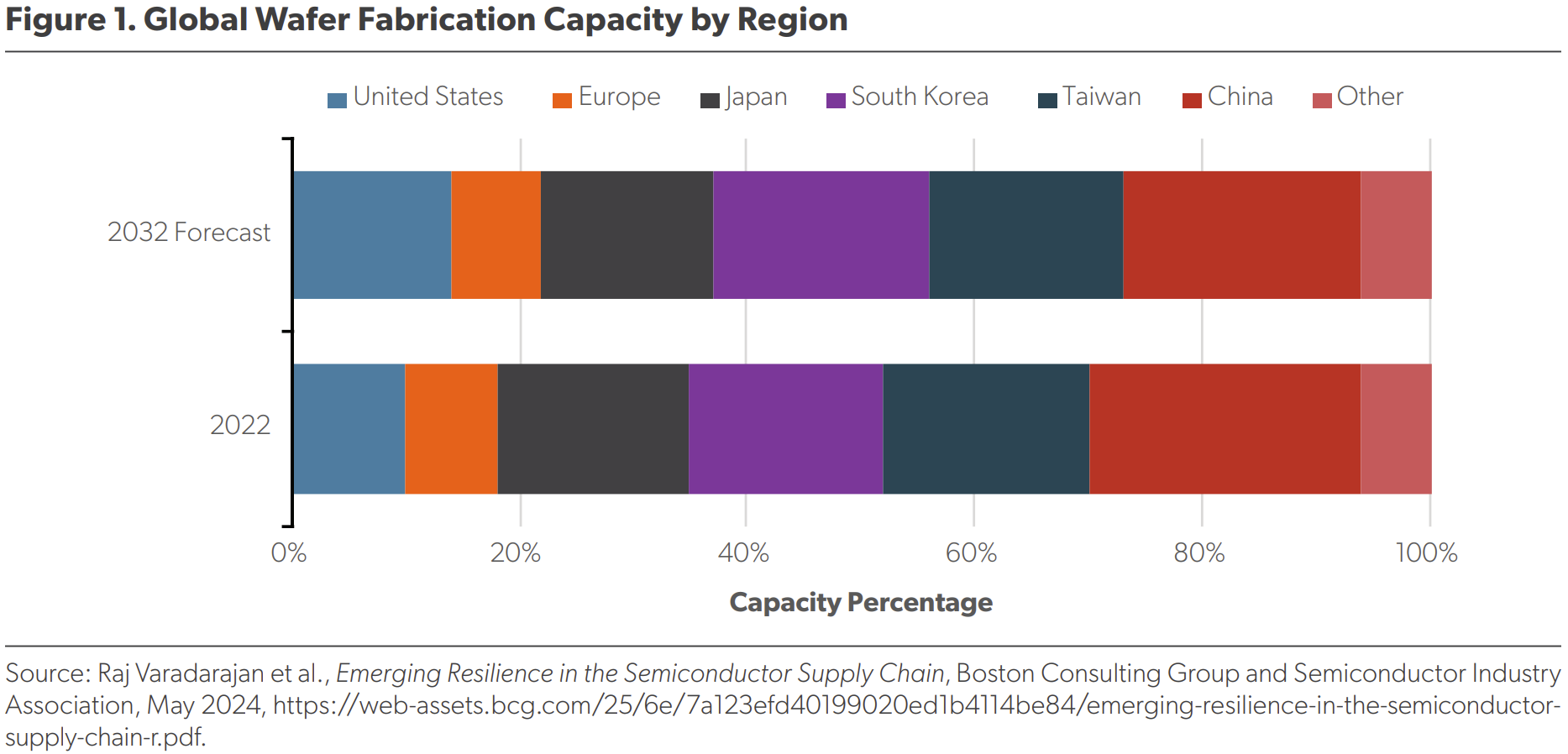

To understand the situation better, it’s essential to look at how semiconductor trade data is compiled. Much of the trade data reflects completed products, such as smartphones or cars, rather than the individual chips they contain. For instance, although the U.S. produces only about 10% of the world’s chips, it consumes nearly a quarter. The trade data appears misleading because many semiconductors are embedded in devices and reflected only as completed goods.

A significant amount of semiconductors imported into the U.S. essentially goes unrecognized in trade data. Calculations suggest that approximately $50 billion worth of chips imported into the U.S. are disguised as components of other goods. Countries like China, Vietnam, and others play vital roles in this complex supply chain, exporting finished products rather than individual chips.

The U.S. buys more chips from nations such as Malaysia and Mexico than from major chip-producing countries like Taiwan and South Korea. The relationship is reciprocal; these exporters often import chips from the U.S. for their manufacturing processes. Consequently, many chips meant for these countries are actually sourced from the U.S. and then sent back after packaging.

The current investigations into semiconductor trade are critical, especially regarding tariffs targeted at reducing reliance on foreign semiconductors. Focusing only on the $40 billion in reported chip imports overlooks the vast majority of chips used in the U.S. that do not appear in trade data. Furthermore, imposing tariffs on these chips risks penalizing domestic manufacturers engaging in high-value production.

Policymakers should carefully consider which countries to target with tariffs. China, with its trade barriers and subsidies, is a prime candidate, whereas countries like Japan and South Korea that maintain open markets may be unfairly impacted by broad tariff measures. Solutions should focus on targeting the actual source of trade distortions, specifically to enhance domestic manufacturing without reducing competitiveness.

Ultimately, any tariff strategy must balance the protection of American manufacturing interests with the goal of fostering international cooperation and competition in the semiconductor industry.

The content above is a summary. For more details, see the source article.